Trump Powell interest rates: Trump Reestablishes Assaults In the midst of Worldwide Exchange Tensions

The Trump Powell interest rates dispute is back in the spotlight. In a renewed attack, former President Donald Trump criticized Federal Reserve Chair Jerome Powell for his cautious stance on interest rate cuts—reviving the Trump Powell interest rates debate amid intensifying global trade tensions. In a reestablished assault, previous President Donald Trump criticized Government Save Chair Jerome Powell for his cautious position on financial policy—reigniting the Trump Powell interest rates talk about amid a time of raising worldwide exchange pressures. This recharged clash highlights the persevering difference over techniques to fortify U.S. financial growth.Read more on Trump’s economic strategy here.

Trump’s comments taken after the European Central Bank’s third intrigued rate cut of the year, provoking worldwide calls for extra facilitating. Numerous see Trump’s comments as an endeavor to weight Powell into embracing more forceful rate cuts—especially as expansion moderates and subsidence concerns endure. With race season drawing nearer, the Trump-Powell intrigued rate talk about is anticipated to stay at the bleeding edge of both financial and political conversations.

“Termination cannot come quick enough!” – Donald Trump on Jerome Powell

Trump Powell Interest Rates: Fed’s Cautious Reaction Sparks Debate

The Trump Powell interest rates feud isn’t new—since appointing Powell in 2017, Trump has repeatedly clashed with the Fed Chair over cautious monetary policy.—even in spite of the fact that Trump assigned Powell to lead the Government Save in 2017. Since at that point, their relationship has been stamped by rehashed pressures. Trump regularly criticizes Powell’s cautious approach to rate cuts, calling it a boundary to solid financial growth.However, Powell pushes back on this account. He cautions that the exceptionally taxes Trump advances may harmed the economy—slowing force, disturbing worldwide supply chains, and driving swelling. From Powell’s point of view, money related approach must remain grounded in information and long-term objectives, not political weight or reactionary moves.

"The level of the tariff increases... is significantly larger than anticipated." – Jerome Powell

This contact underscores a broader challenge: protecting central bank freedom amid times of financial and political turbulence.

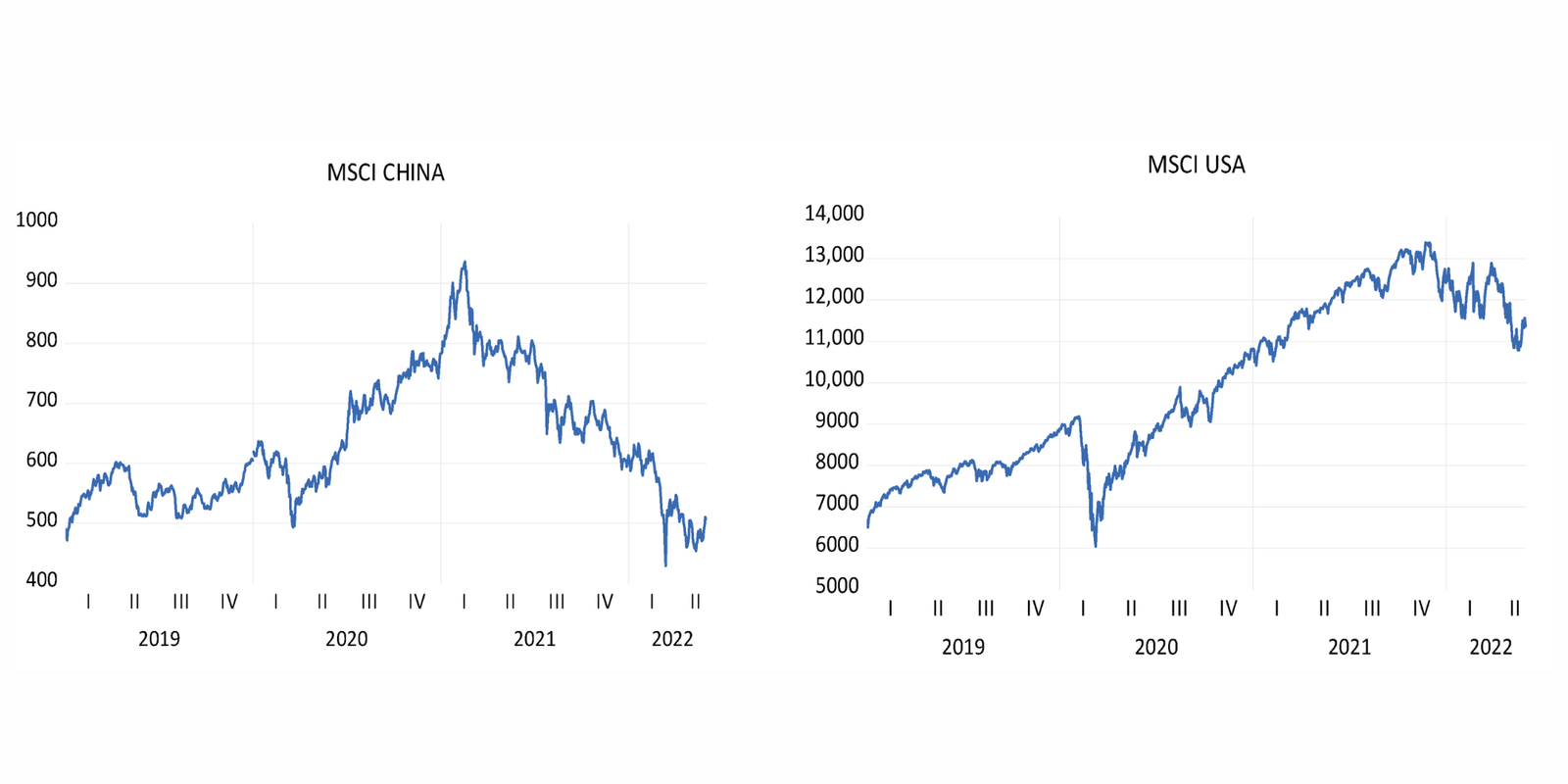

Trade Pressures: U.S.–China Duty Escalation

The Trump Powell interest rates conflict plays out against a backdrop of global uncertainty, driven largely by the U.S.-China trade war and policy friction., intensely impacted by the U.S.-China exchange war. Trump’s choice to force soak duties on Chinese imports activated retaliatory measures from Beijing, counting noteworthy obligations on American goods.

This tit-for-tat has shaken markets, disturbed worldwide supply chains, and made instability over businesses. The coming about financial strain has escalates weight on central banks to act decisively.

“The level of the duty increments… is altogether bigger than expected.” – Jerome Powell

Powell as of late recognized that tax impacts are outperforming the Fed’s worst-case projections. He cautioned that moment costs and vulnerability are weighing intensely on financial figures. As worldwide central banks react with jolt measures, Powell highlighted the trouble of making national arrangement in an interconnected world.

Inflation Pressures in the Trump Powell Interest Rates Debate

While Trump continues pushing for lower rates, the Trump Powell interest rates dispute highlights deeper divisions in how to navigate inflation and recession risks.Powell remains centered on the Government Reserve’s double command: steady expansion and most extreme business. This adjusting act gets to be more complex with rising taxes and conceivable customer cost spikes.According to the Bureau of Labor Insights, expansion weight is mounting. Powell faces a intense choice—cut rates to energize development or hold relentless to dodge overheating costs. He demands on holding up for clear financial signals some time recently making any adjustments.

“We would consider how far off the economy is from each objective.” – Jerome Powell

Economists caution that forceful rate cuts may backfire—fueling expansion or making resource bubbles. Untimely moves may weaken Encouraged validity and flag politicization of money related approach. Powell emphasizes autonomy, demanding choices must be data-driven.

Tariffs: Key Win or Financial Risk?

Trump contends tariffs help the U.S. economy, but the Trump Powell interest rates dispute adds another layer of complexity to an already volatile economic strategy by raising government income and securing household businesses. He accepts combining duties with moo interest rates would assist invigorate development, boost investing, and counterbalanced cost hikes.

However, financial information tell a diverse story. Taxes do raise income, but most of the burden falls on shoppers and businesses. Costs on fundamentals like eggs and basic supplies have risen, undermining the claim that taxes lower costs.

Analysts caution of long-term harm if tall duties hold on. Supply chains are moving, generation costs are rising, and universal exchange is dividing. The coming about cost climbs strain shoppers and businesses alike.

The World Exchange Organization has cautioned that protectionist arrangements may shrivel worldwide exchange and prevent participation. Whereas Trump’s approach has solid supporters, specialists stay doubtful of its long-term viability.According to the Federal Reserve, inflation targets remain central to policy decisions.