A Timeless Image: The Birth of the Blue Marble

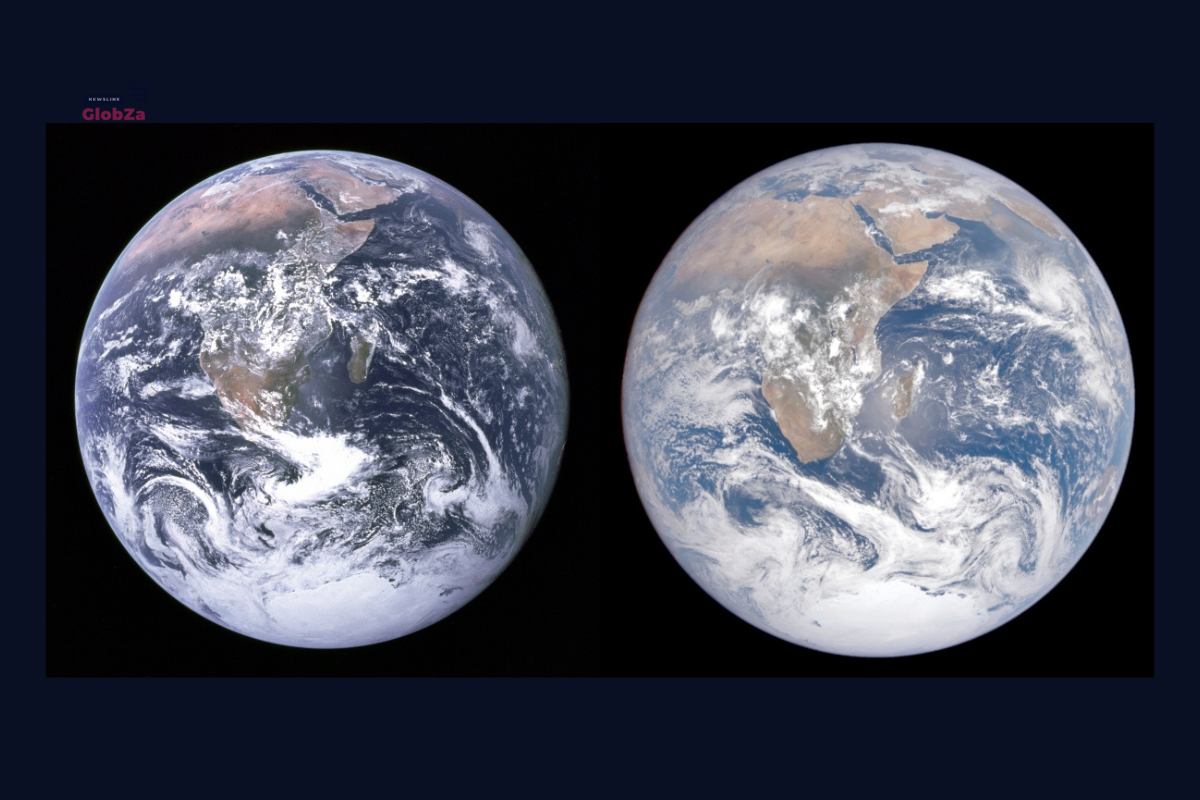

The Apollo 17 mission didn’t just close out the Moon landings. It gave humanity its first complete view of Earth fully illuminated by sunlight. Floating 29,000 kilometers away, astronauts Eugene Cernan, Ronald Evans, and Harrison Schmitt captured the now-iconic photo using a hand-held Hasselblad camera.

Astronaut Schmitt reflected, “Right now, Earth looks like the most delicate shade of blue floating in space—truly fragile in appearance.”

Today, thanks to satellite imagery, we can see how climate change from space has visibly transformed that same blue marble over the past 50 years.

From Film to Satellite: How Earth Imaging Has Evolved

In 1972, astronauts captured Earth manually. Today, satellites like NASA’s Earth Polychromatic Imaging Camera (EPIC) do it automatically — every 60 to 120 minutes. Operating across 10 spectral bands, these cameras provide detailed insights into the planet’s atmosphere, vegetation, and water systems.

The shift from analog to hyperspectral technology has made tracking climate change from space more accurate than ever.

Ice Loss in Polar Regions: A Visible Crisis

One of the most striking differences between the original photo and current images is the noticeable retreat of polar ice.

The Cryosphere in Decline

Antarctica is currently losing approximately 150 billion tons of ice annually.

The Arctic is melting even faster — about 280 billion tons annually.

Permafrost thaw and glacial melt contribute to rising sea levels and disrupted ocean currents.

These transformations are clearly visible in satellite images.many of which are publicly available through the NASA Earth Observatory.”

Vegetation Loss: From Green to Brown

Satellite comparisons show vast changes in vegetation, especially in the Amazon and African Sahel.

Deserts Expanding, Forests Shrinking

The Sahara Desert continues to spread southward.

The Amazon Rainforest, once lush and dense, now shows visible signs of deforestation and fire damage.

NASA confirms declining tree cover and biodiversity in equatorial zones.

What was once green from space is now turning brown.

Urbanization: Cities Lighting Up the Night

While the Blue Marble shows Earth during the day, nighttime satellite images from the VIIRS system reveal something new — rapid urban sprawl.

A World That Glows

Cities like New Delhi, Lagos, and São Paulo have tripled in area.

Rural areas now sparkle with new infrastructure and dense populations.

From orbit, the human footprint is increasingly bright and unmistakable.

Climate Patterns and Clouds: Weather in Flux

Satellites also show changes in cloud structures, a key indicator of climate behavior.

Signs of a Changing Sky

Increased storm activity, especially in tropical regions.

Higher cloud heights linked to warming.

Jet stream shifts causing unusual droughts and cold waves.

These changes are no longer hidden — they are visible through real-time space imagery.

Oceans from Above: A Change in Color

Ocean color reflects health. Chlorophyll levels — visible from space — help gauge the vitality of marine ecosystems.

Oceans Losing Life

Phytoplankton levels are dropping in some equatorial zones.

Ocean warming and acidification are threatening marine biodiversity.

Coral bleaching, including in the Great Barrier Reef, can now be seen from space.

These are not abstract data points — they are visible environmental shifts.

The Atmospheric Lens: Aerosols and Ozone

Modern technology allows satellites to detect atmospheric changes invisible in 1972.Pollution in the Air High aerosol concentrations over South Asia, China, and parts of Africa indicate pollution and biomass burning.Though ozone levels are improving due to the Montreal Protocol, depletion persists over Antarctica.The atmosphere appears hazier — visibly altered by human activity.

Natural Disasters from Orbit: Fires and Floods

EPIC and other satellites monitor real-time disasters, offering a clear view of their growing intensity.

Disasters on Display

Massive wildfires in Australia, California, and the Amazon are visible from orbit.

Floodplains in South Asia have expanded, leaving lasting marks on landscapes.

Heatwaves create distinct patterns in surface temperatures and visibly impact vegetation health, often leading to scorched landscapes and reduced plant vitality.

These aren’t isolated events. They contribute to a larger climate feedback loop, where rising temperatures trigger environmental changes that, in turn, intensify global warming.

NASA’s EPIC camera, positioned a million miles from Earth, captures stunning full-disk images of our planet. It helps scientists monitor climate, weather, and pollution—while reminding us of Earth’s beauty and fragility.

NASA’s DSCOVR satellite orbits at Lagrange Point 1, about 1 million miles from Earth. From there, EPIC delivers uninterrupted images of the planet’s sunlit side.

- A New Way to See Home

High-res images every 15 minutes - Data used for climate models, storm prediction, and even global movement tracking

- A powerful tool in understanding climate change from space

Conclusion: The Blue Marble, Then and Now

The original Blue Marble showed us a whole, beautiful planet. Now, satellite imagery reveals a planet in flux:

- Ice caps are shrinking

- Deserts are growing

- Forests are disappearing

- Seas are rising

- Cities are sprawling

- The atmosphere is changing

These shifts are no longer theoretical. We can see climate change from space — and it’s a clear call to action.

As astronaut Cernan once said, “It’s out there all by itself.” Just like Earth — alone, and clearly calling for urgent change.

China’s Ghost Network: The Truth Behind the First 10G Internet